Life Insurance For Single Moms is a thing and it doesn’t have to be scary!

Life Insurance For Single Moms is a thing and it doesn’t have to be scary! Don’t let intimidation and fear stop you from protecting the ones you love.

1. Term Life Insurance (Best Overall Choice)

Term life insurance provides coverage for a set period, such as 20 or 30 years.

Why it works well for single moms:

- Lowest cost for high coverage

- Ideal for income replacement

- Coverage can last until children are financially independent

Example:

A healthy 35-year-old single mom may qualify for $500,000 of coverage for $20–$35 per month, depending on health and term length.

2. Whole Life Insurance (Lifetime Coverage Option)

Whole life insurance lasts for life and builds cash value.

Pros:

- Coverage never expires

- Fixed premiums

- Can help with final expenses

Cons:

- Higher monthly cost

- Less coverage for the same price

This option may work for single moms who want guaranteed lifelong coverage and can afford higher premiums.

3. Final Expense Insurance (For Burial and End-of-Life Costs)

Final expense insurance provides smaller coverage amounts, usually $5,000–$25,000.

Best for single moms who:

- Are older or have health conditions

- Want to cover funeral costs only

- Do not need income replacement

It is not ideal for raising children financially, but it can prevent loved ones from facing burial expenses.

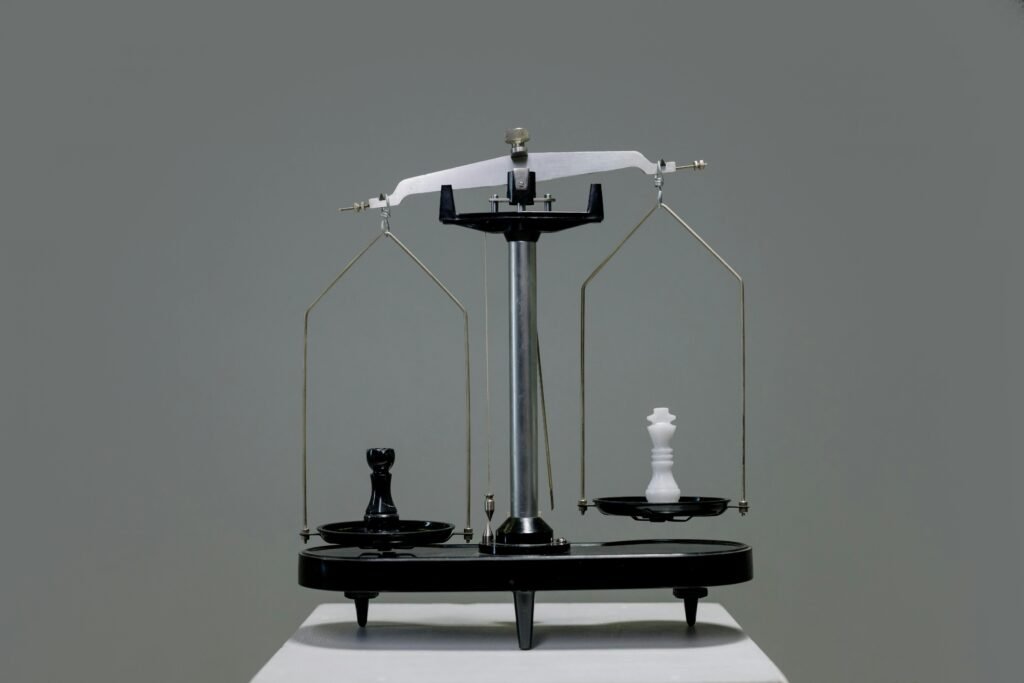

Term Life vs. Whole Life for Single Moms

| Feature | Term Life | Whole Life |

|---|---|---|

| Cost | Lower | Higher |

| Coverage Amount | Higher | Lower |

| Length | 10–30 years | Lifetime |

| Cash Value | No | Yes |

| Best For | Income replacement | Long-term planning |

How Much Life Insurance Does a Single Mom Need?

A common rule of thumb, according to RamseySolutions.com, is 10–15 times your annual income, but personal factors matter.

Consider:

- Your income and years until retirement

- Childcare and education costs

- Mortgage or rent

- Outstanding debts

- Future college expenses

A licensed insurance agent can help calculate a realistic coverage amount based on your situation.

Common Mistakes Single Moms Should Avoid

- Choosing too little coverage: Funeral-only policies often fall short

- Naming minors directly as beneficiaries: This can delay payouts

- Waiting too long to buy: Rates increase with age and health changes

- Relying only on employer coverage: It may end if you change jobs

Setting up a trust or guardian arrangement can help ensure funds are managed responsibly for children.

Frequently Asked Questions

Can a single mom get life insurance with no medical exam?

Yes. Many term and whole life policies offer no-exam options, though premiums may be slightly higher.

What happens if I can’t afford payments later?

Some policies allow conversion, reduction, or cancellation. Always review flexibility options before buying.

Is life insurance worth it if money is tight?

Even modest coverage can make a big difference. Term life is often very affordable and provides strong protection.

Can life insurance help with college costs?

Yes. The death benefit can be used for any purpose, including education expenses.

Getting the Right Coverage as a Single Mom

Life insurance is not about fear—it’s about responsibility and love. The right policy helps ensure your children are protected, no matter what.

At InsurVIAlife, we focus on education first. We help single mothers explore options and connect with licensed insurance agents who understand family-focused planning.

👉 Compare life insurance options or speak with a licensed agent to find coverage that fits your budget and your children’s needs.

Author & Trust Disclosure

This article was created by InsurVIAlife, a U.S.-based life insurance education resource. Information reflects common industry practices and data from organizations such as LIMRA, NAIC, and the Insurance Information Institute. Content is for educational purposes only and does not provide legal or tax advice. Always consult a licensed insurance professional for personalized recommendations.

Leave a Reply